Guide Steps

Do steps after validating 1099 records via the 1099 report

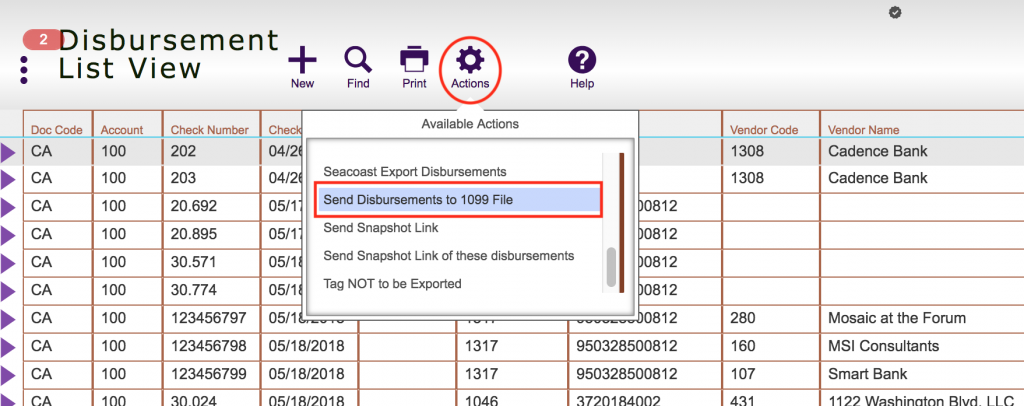

Navigate to Disbursements > List view, click the Actions button and Select Find 1099 Records

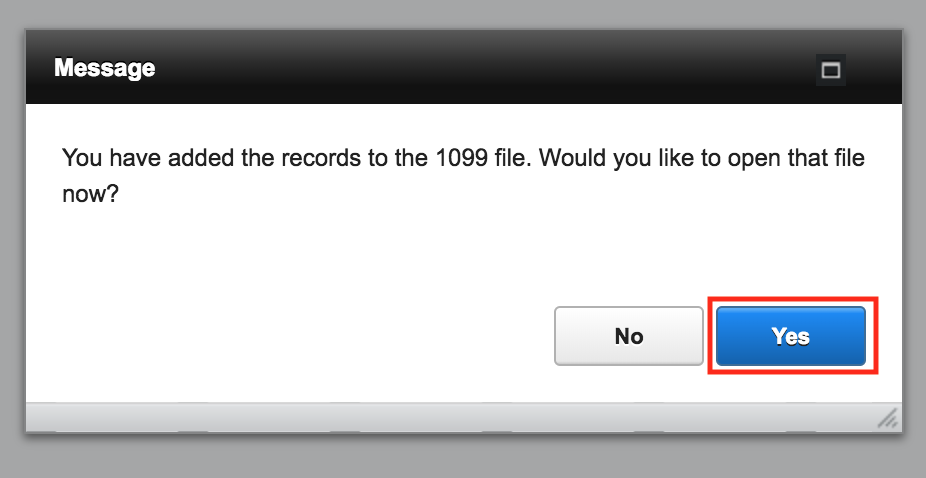

Select Yes in the next window, and enter in your username and password if prompted to open the Tax File

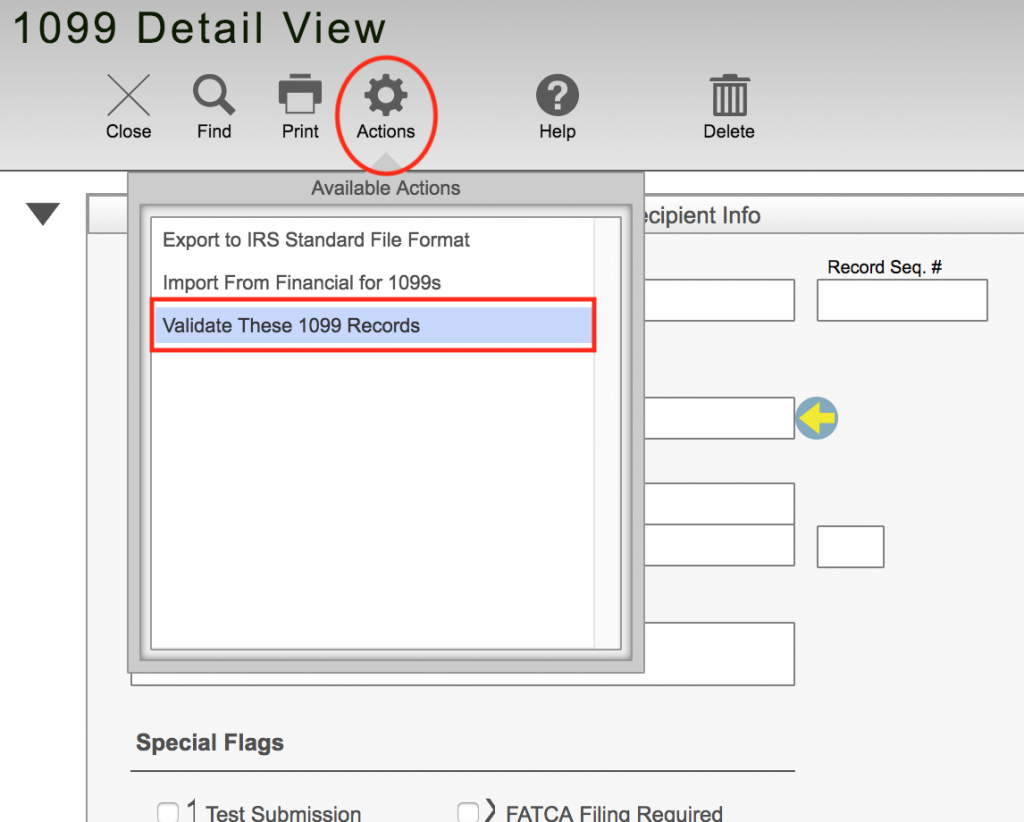

Click on the Actions button and select Validate These 1099 Records

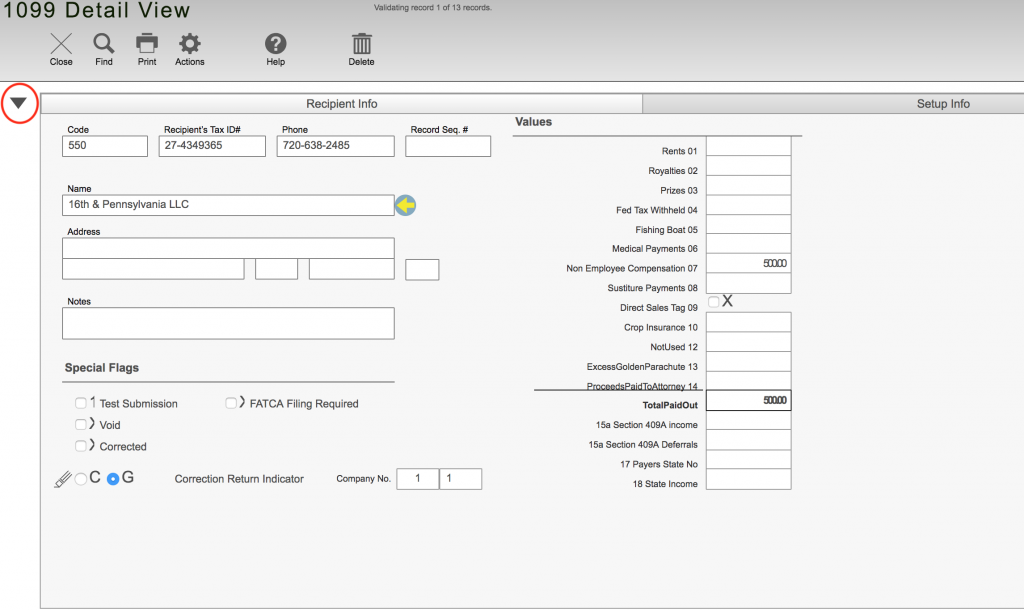

You can click on the black triangle to view a list of the records to see them all at once

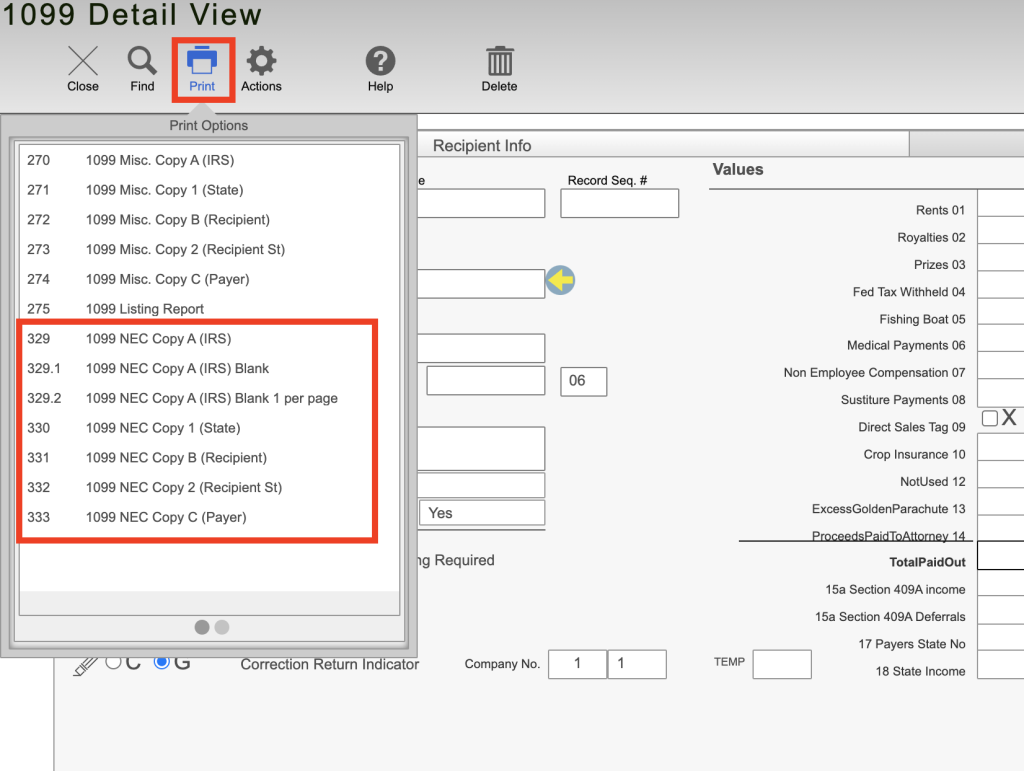

You can now print your 1099 for the vendors, or generate the IRS file in the next steps

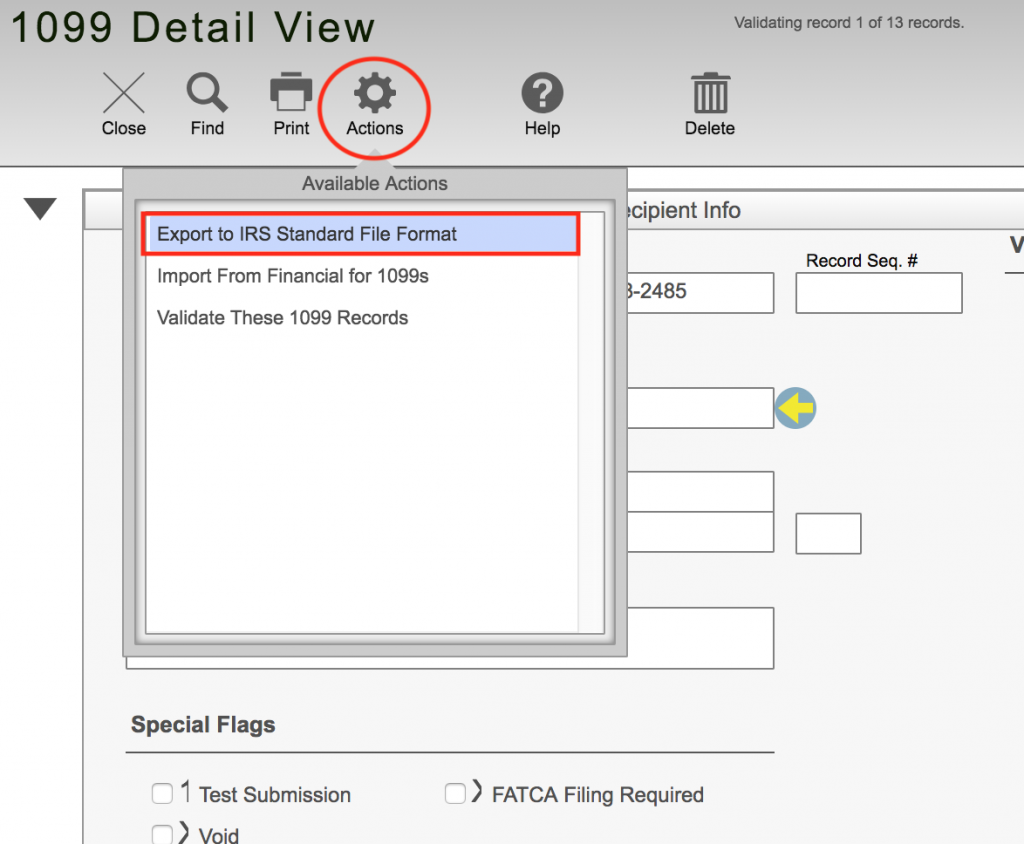

Exporting the FIRE file for IRS

Once the records have been validated, click the Actions button and select Export to IRS Standard File Format

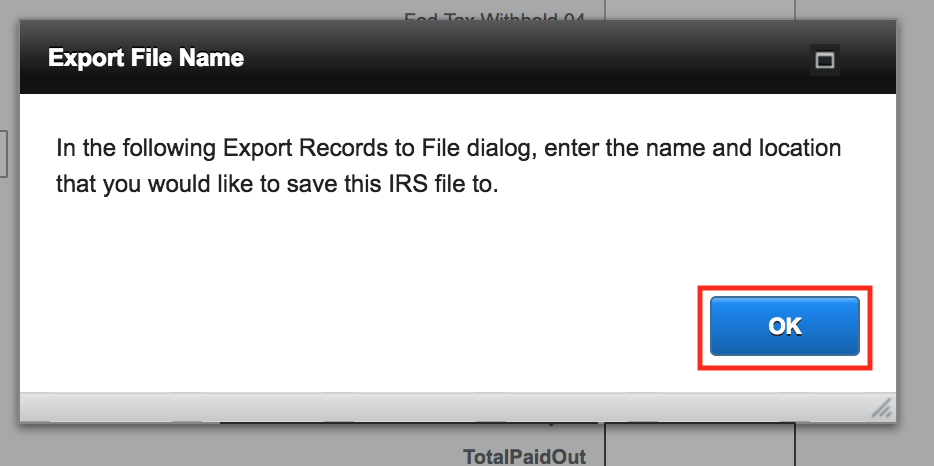

Click OK

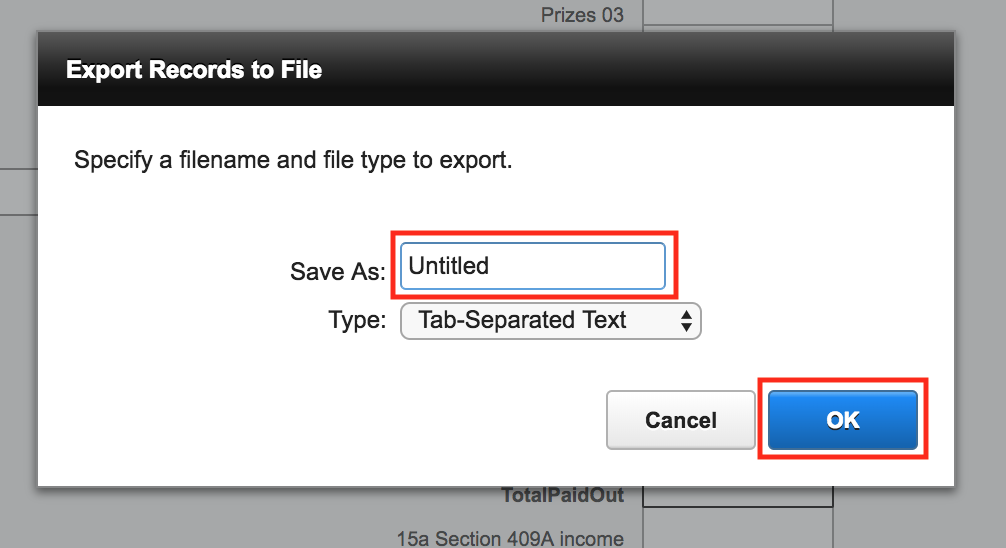

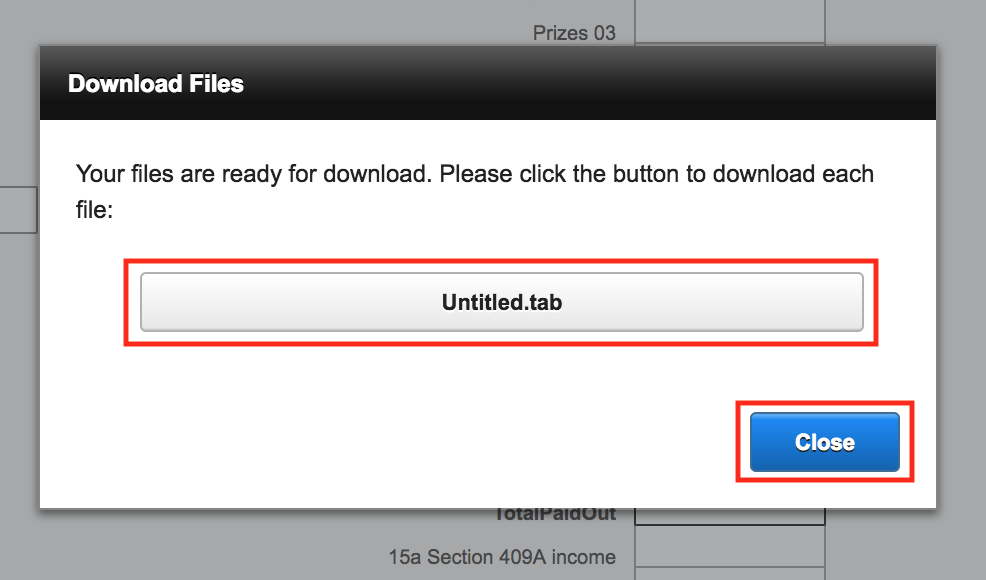

Then Name the File and make sure the Type is Tab-Separated Text, then click OK

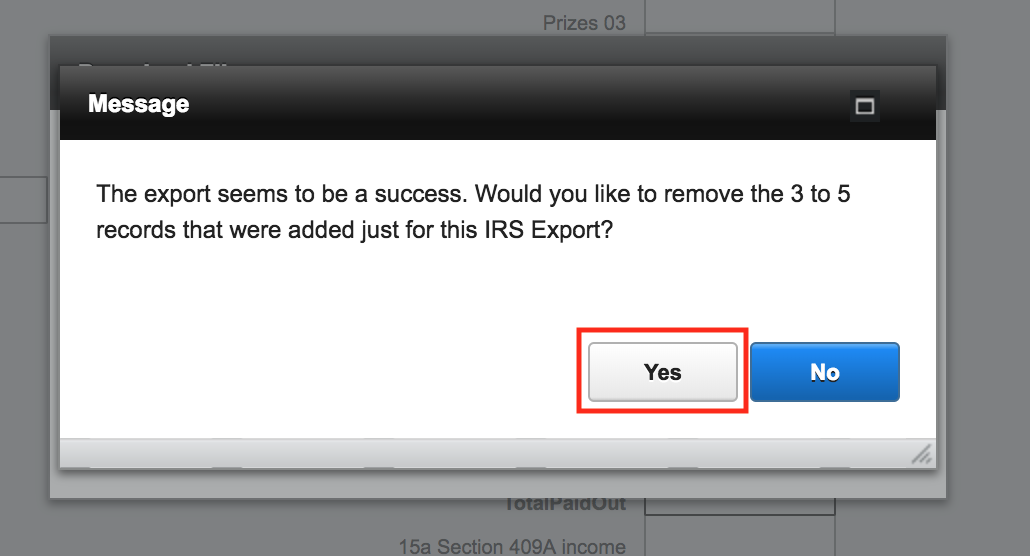

Click OK and then click Yes to remove the records that you just exported or No if you want to still keep them in the file