Guide Steps

Navigate to the General Ledger Codes area

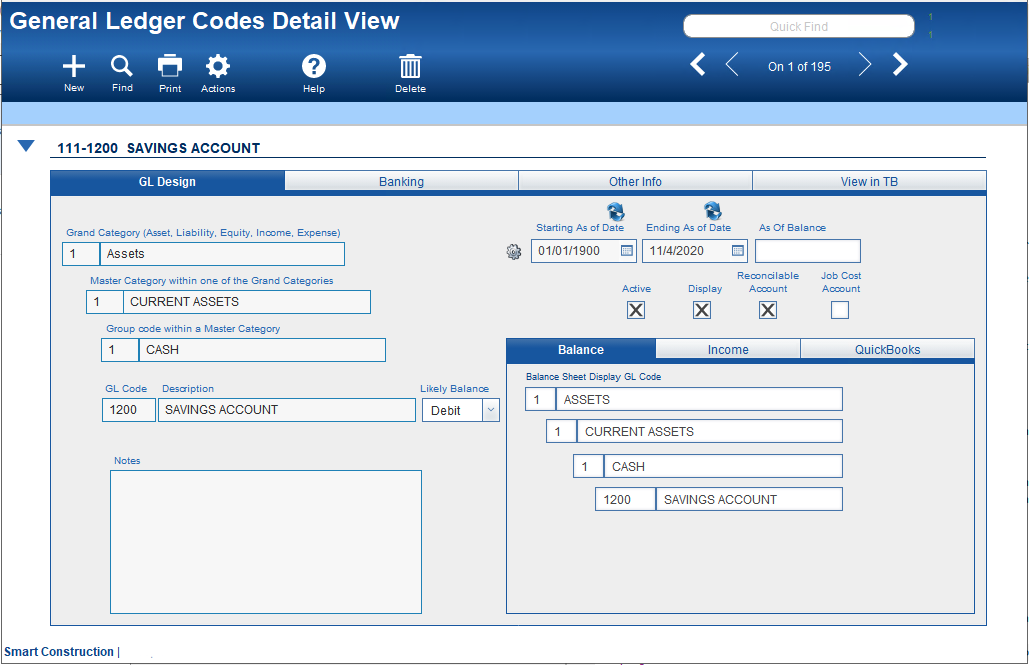

- Navigate to Setups > General Ledger Codes > Detail View

- Click New

Fill In the Information About this new Account

A General Ledger Account has three basic design elements. 1) The hierarchy; 2) Income Statement Grouping; and 3) Options.

The Hierarchy

This is how a GL Code is sorted and “Grouped” on your financials. The highest level is the Grand Category. This should at least represent one of the five top-level accounting groups such as 1=Asset, 2=Liability, 3=Equity, 4=Income, and 5=Expense. The next two groups Master Category and Group code, are designed to group and summarize GL codes together on your financials. These can be anything that makes sense to you for how you want to see your financials. And finally, the GL Code and Description. This will be the account code that will be used on your Financial Transactions. Care should be taken in designing this code so that you have room to create new codes if needed, and accounts are presented in a clear and logical format.

Grouping

There are two Financial Groupings, one for Balance Sheets and the other for the Income Statement. The Balance sheet financial grouping is automatic, and the only thing that you will need to do is make sure that your default “current earnings” GL code has been assigned. For the Income financials grouping, you’ll what to assign an Income Statement Grouping. The Income Statement Grouping works differently than the hierarchy grouping because its summaries are cumulative. Typical groupings here would be like “10 – Gross Profit” or “20 – Net Operating Profit/Loss.” For example, your income accounts and cost of goods sold expense accounts would most like to be grouped together as “Gross Profit.”

Options

There are four basic options that you can “check” for a GL Code:

- Active = checking this option will allow users to be able to use this GL Code.

- Display = this always defaults to on, but if you check it off, this GL Code will not display on your printed Financial statements. Caution should be used if unchecking this option since this could make financial to appear “out-of-balance.”

- Reconcilable Account = Check this option if this account represents an item that “statements” are produced by third parties. The most common is Banks who will prepare statements of the transactions for your checking account. By checking this option, you’ll be able to “reconcile” this account within CMIS.

- Job Cost Account = Check this option if this account is used purely for Job Costing reasons. Often used for accounts that are used at the Project level to track income and expenses through different phases of a project.

Guide Screenshot Reference